- The Caffeine Capitalist

- Posts

- Batch brew #26

Batch brew #26

Startups out of Steam, Venture Studio & Boring Businesses on the rise & Productised Services

Hey, the autumn Caffeine Capitalist Sunday Edition is here! 🍁

Seems like all the typical activities in this stage of the financial cycle are in place, Carta brings us some data about startups going bankrupt, quite chilling. On the other hand, the interest in boring businesses, at least from what we feel in conversations, is booming and that is good. And even more so in Startup Studios, get ready for a longer read on this topic.

In the last issue we spoke about positive cashflow and EBITDA positive companies, we feel that this conversation is ever more important when looking back at the previous few years.

Enjoy your coffee fresh, head down and keep hustlin’!

5 minutes and 12 seconds this time.

Dept. of Tiny Thoughts

“No matter how many decision-making techniques you learn, if you're always possessed by the moment and make decisions on a whim, none of them will help.”

In the world of business, just like in brewing the perfect cup of coffee, consistency is key. While the thrill of spontaneity can be alluring, making decisions in the heat of the moment can leave a bitter aftertaste. Just as you wouldn't suddenly change your coffee beans and expect the same flavor, shifting strategies or choices impulsively can disrupt the rhythm of your business.

As you sip your next cup, mull over this: Are your decisions being brewed with careful thought or are they more like instant coffee – hasty and lacking depth?

If you want more of these thought provoking ideas, I suggest getting yourself a copy of Shane’s new book called “Clear Thinking”, you’ll thank us later ☕

Dept. of Insights - Venture Studios on the rise, again?

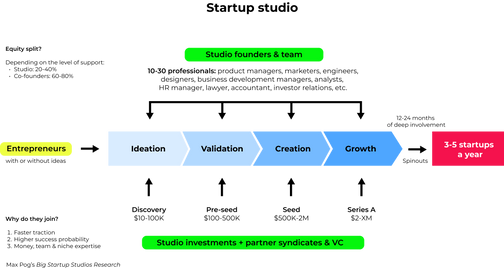

Have you also caught it? In the last few months I hear more and more people looking into the idea of launching a venture/startup studio. At Kiuub we support these studios by reducing their dev costs by up to 70%, so I though, why not look deeper into this topic.

After brief research in the VC Lab community I found Max Pog's research on the topic which is the best you can find on the internet, and yes I provide the link to it too.

Our aim here was to scratch the surface a little, provide you with some basic arguments and drivers, but most importantly, give you further resources for your Venture Studio journey.

The Rise: The venture studio model is attractive, built ideas simultaneously, share resources etc., no wonder it attracts many people these days.

Resource Synergy: In a world where time is of the essence, the integrated ecosystem of venture studios offers immediate access to everything from tech stacks to marketing arsenals. This interconnectedness ensures that startups can hit the ground running.

Diversified Portfolio: The ability to cultivate multiple startups concurrently is not just about spreading risk—it's a testament to the dynamic nature of the model. Data even suggests a higher trajectory for these startups, with a notable edge in securing future funding rounds.

The Risks: But as with any pioneering approach, the venture studio model presents its set of challenges. The journey is not without its thorns.

Equity Dynamics: The question of equity is paramount. Founders tread a delicate balance between the immediate bounty of resources and the long-term implications of equity distribution.

Initial Overheads: Beyond the capital, there's the mammoth task of setting up a robust infrastructure—a challenge that requires foresight and strategic planning.

Amidst this evolving narrative, a quiet revolution is bolstering the venture studio model's appeal—the no-code movement.

The No-Code Revolution: The digital age has been a game-changer, but the no-code movement is its crown jewel. For venture studios, this translates into unparalleled agility.

Efficiency Boost: Gone are the prolonged development cycles. No-code platforms are ensuring venture studios can iterate at breakneck speeds.

Scalability: With tools that can be deployed across ventures, the promise of consistent innovation becomes a tangible reality.

Sarah Klein, a luminary in the venture studio space, recently reflected, "Venture studios are the crucibles where innovative ideas are tested, refined, and brought to life. They're the future of entrepreneurship."

For those seasoned in the startup realm, the venture studio model offers uncharted territories ripe for exploration. If this narrative resonates with you and you're intrigued by the possibilities, reach out to a us for a chat, we have been collecting interesting insights on the ops side of the Venture Studio & are happy to help.

For a long read, you must not miss the whole report by Max below, this article and a link to this database. Enjoy the read! ☕

Dept. of Twitter Thread Research (we can’t get our head around the generic “X”):

1/ Boring RVs. A super long thread on the whole RV biz, not so transferable to Europe, but a solid inspo:

You don't need more employees, you need a better business model.

I know people who make $1M/year+ with no payroll.

One way to do it is something called "Productized Services."

Ever heard of Designjoy?

Here's how he leveraged this framework (so you can steal his homework):… twitter.com/i/web/status/1…

— Codie Sanchez (@Codie_Sanchez)

1:41 PM • Oct 18, 2023

2/ This one by Shaan hits home. What would you do if you had to launch tomorrow?

Our Fast Tree Care success has people asking

"What other high ticket home services would crush?"

Luckily, I LOVE studying this stuff!

The below 36 ideas fit this mold:

- High ticket

- Growing industry

- Can be subbed out

- Scalable via growth hacking or ads

--

1. Geothermal… twitter.com/i/web/status/1…— Chris Koerner (@mhp_guy)

3:25 PM • Oct 16, 2023

Dept. of Visual Research:

Yup Carta brings us the harsh truth about startup closures in these quarters. Not much more to say about it, apart from the hope that we have hit the bottom already:

Carta

News from our portfolios & where to shake hands:

Slavo will be travelling to Houston and Austin between 29th October & 7th November, feel free to reach out if you are around :)

It was great meeting you all at the Engaged Conference in Prague this week.

Do you enjoy this type of content? Over 1700 subscribers are supporting us, but we want to grow further and the best way you can help us is to share The Caffeine Capitalist in your community using the button below:

Enjoy your coffee fresh, allocate capital, repeat! See you in 2 weeks 👋

The Caffeine Capitalist is a bimonthly newsletter written by Slavo Tuleya, Andrej Petrus & Martin Nemecek. It is written in partnership & in support from ZAKA.VC and Chop Chop Ventures.

What do you think of this issue? We are still collecting feedback on our new layout, suggestions welcome!

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.